ERS Trust Fund performance in the first quarter of CY24

5-minute read

The Employees Retirement System of Texas (ERS) Retirement Trust Fund (“the Fund”) continues to deliver well on its long-term investment goals. The Fund supports current and future earned benefits by maintaining a highly diversified portfolio of investments.

Once state agency employees become eligible, their retirement annuity is guaranteed for life, no matter what happens with ERS’ investments. Good management of public retirement trust funds like ERS is good for the state’s overall financial health, to the benefit of all Texans.

Highlights

- $38.8 billion in market value – As of March 31, 2024, the Fund’s market value is $38.8 billion, a gain of approximately $1 billion since the end of the previous quarter and $4.91 billion since the first quarter of Calendar Year 2023.

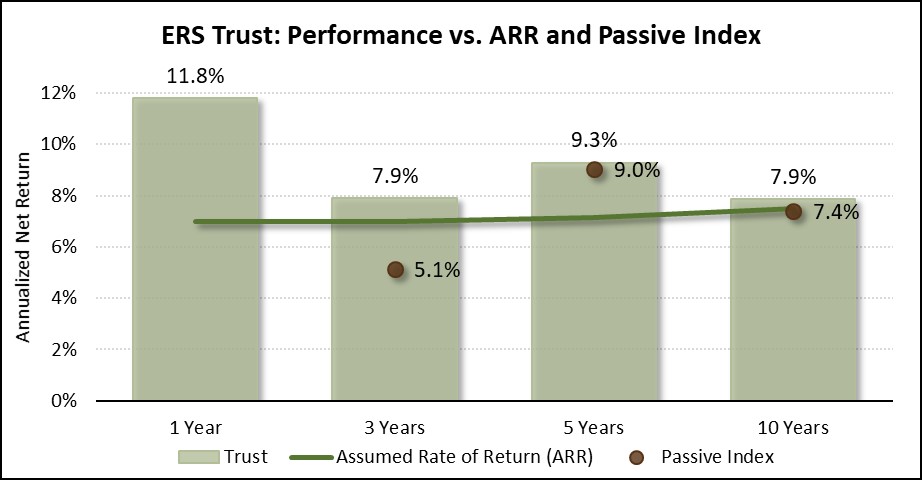

- Five-year returns of 9.3% – The Fund’s annualized 9.3% return over the last five years was above the 7% assumed annual rate of return.

- Top performer among peers – The Fund is recognized among its peers as one of the top-performing public pension funds in the country, including the top 3% over the last three years.

The Fund outperformed the 7% assumed annual rate of return over one, three, five and 10 years.

- Assumed annual rate of return (ARR): the investment return ERS’ retirement actuaries expect from the Fund each year to ensure ERS can meet its commitments over the long term.

The Fund’s investment earnings are doing better than its policy benchmark over one, three, five and 10 years.

- Policy benchmark: the standard against which ERS measures the Fund’s performance. There are benchmarks for every type of investment and strategy. The Standard and Poor’s 500 (S&P) index and Dow Jones Industrial Average (DJIA) are examples of two popular benchmarks in the U.S. equity market.

- Passive Index: a portfolio designed to mirror the returns of indices with a passive mix of 80% stocks and 20% bonds. ERS uses the Passive Index as another benchmark against which to measure the Fund’s performance.

In the three-year period ended March 31, 2024, the Fund return of 7.9% was above the assumed rate of return of 7%. The Fund’s three-year return outperformed the policy benchmark by 2.19% and ranked in the top third percentile of peers.

On a five-year basis, the Fund’s relative returns over the policy benchmark are among the highest in ERS’ history, and within the top 10% of public retirement funds of $1 billion and above. In fact, over most of the timeframes ERS monitors, the Fund is recognized among its peers as one of the top performing public pension funds in the country.

ERS’ Private Equity Program has been the largest source of the Fund’s five-year excess return, followed by Private Real Estate and Global Credit.

Reference the May 2024 ERS joint Board of Trustees and Investment Advisory Committee meeting to find out more about the performance of specific asset classes during the first quarter of CY24.

Why investment performance matters

The State of Texas Retirement program for state agency employees is a defined benefit plan that will provide the employees with a stable, lifelong income when they become eligible and retire. ERS prudently invests contributions from employees, the state and agency employers through the ERS Retirement Trust Fund. The Fund supports current and future earned benefits.

When employees retire from state employment, they will receive a monthly annuity payment from ERS for the rest of their life regardless of the Fund’s investment performance. By design, about 60% of retirement annuities currently are paid from the Fund’s investment earnings. Contributions from the state and active members over their career account for the other approximately 40%.

For employees in ERS Retirement Group 4 (state agency employees who started on or after Sept. 1, 2022), their lifetime retirement annuities will be based on how much money is in their ERS retirement account when they retire, including a 150% match of the entire account balance at retirement. Their account balance includes Group 4 employees’ contributions, guaranteed 4% annual interest and, through a feature called gain sharing, additional earnings of up to 3% when ERS’ investments earns more than 4% on average over the previous five years. Gain sharing means investment earnings could help increase a Group 4 employees’ State of Texas Retirement account balance and the amount of their monthly retirement annuity. It is important to note that Group 4 accounts will never earn less than 4% interest, even in years when the Fund returns less than 4%.

The five-minute Group 4 explainer video helps state employees understand how gain sharing in the Group 4 retirement benefit works. There is also a video for certified law enforcement and custodial officers (LECOS), who participate in the LECO Supplemental Retirement Fund. Both videos are also available in Spanish.

Reminder: The monthly annuity payment is just one part of state employees’ retirement income. ERS encourages a “three-legged stool” approach to achieving a financially secure retirement. Under this approach, the monthly annuity payment from the Fund is just one part of their retirement income. Social Security makes up another portion of retirement income. Personal savings, like an individual retirement account (IRA) or 401(k), are important to supplement the monthly annuity payment and Social Security. ERS offers the Texa$averSM 401(k) / 457 Program, a voluntary savings program managed by ERS that offers investment flexibility with lower-than-average fees.

Ensuring reliable payments to state retirees

Annuity payments to retirees currently total more than $3 billion per year. ERS must ensure the Fund is well diversified to not only achieve reliable investment earnings over the long term, but also to make sure the Fund has enough money on hand to pay hundreds of millions of dollars in annuities each month.

That much money going out each month means ERS must make different investment choices than an individual managing a personal retirement account—such as a 401(k) or 457—who does not need to withdraw funds regularly.

This prudent approach also allows the earnings from the ERS investment portfolio to meet long-term projections and withstand the market’s ups and downs. This is great news for state agency employees, even if the amount of their annuity does not depend on ERS’ investment performance.